This essay is part of the Islamic Moral Theology and the Future (IMTF) Project, generously supported by the John Templeton Foundation, and co-led by Maria Dakake and Martin Nguyen. It specifically responds to Dr. Nguyen's line of inquiry. Click here to read all past contributions to Dakake and Nguyen’s respective lines of inquiry and stay tuned for new contributions from IMTF in its second year!

In the twenty-first century, economists have increasingly recognized the profound issue of wealth inequality that afflicts societies worldwide. This realization holds true not only in non-Muslim countries but extends to the Muslim world, where disparities in wealth are apparent both within and across nations. The consequences of such inequalities are far-reaching, affecting multiple facets of life, including access to education, healthcare, and economic opportunities. Recognizing and addressing these disparities is crucial to promoting economic justice, social stability, and the overall well-being of communities in the Muslim world.

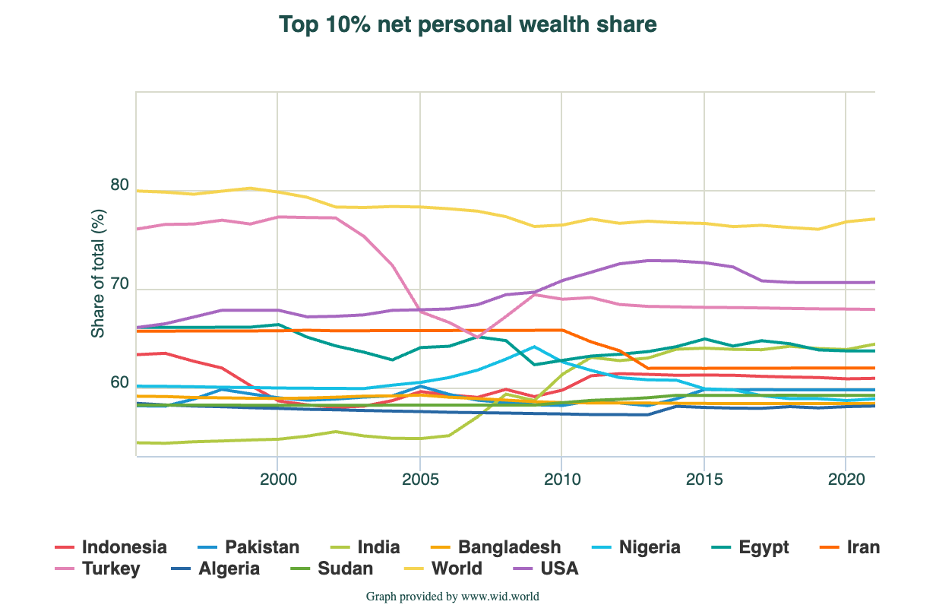

Within the top 10 countries with the highest Muslim population, where approximately 68 percent of the global Muslim population resides, the concentration of personal wealth among the top 10 percent is comparable to the levels observed in the United States and slightly below the global average for wealth inequality.

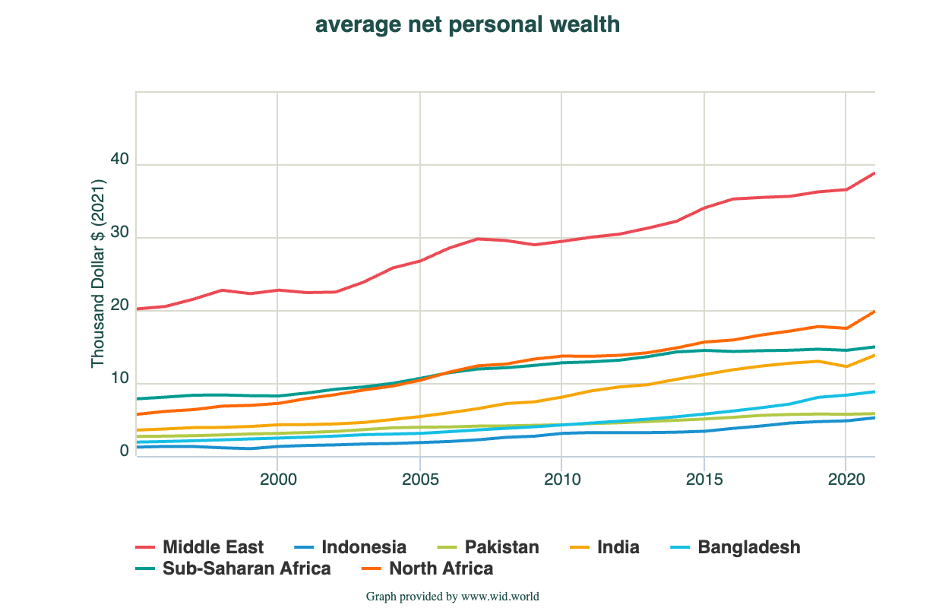

In particular, the Middle East stands out in terms of average net personal wealth compared to other regions with large Muslim populations.

The Ummah, or global Muslim community, cannot afford to be indifferent to such stark contrasts between one people’s prosperity and other people’s struggles. It is true that since the fall of the Ottoman Empire, the concept of a unified Muslim community has become ambiguous, with various interpretations emerging. However, the advent of global trade and travel, the internet, and global communications provides an increased opportunity to view the Ummah and its challenges from a global perspective. Allah addresses the division of people into groups, as seen in Sūrat al-Ḥujurāt (Q. 49:13), whose interpretation of the meaning states, “O mankind, indeed We have created you from male and female and made you peoples and tribes that you may know one another. Indeed, the most noble of you in the sight of God is the most righteous of you. Indeed, God is Knowing and Aware.” In light of this call for unity, let us explore the role zakāt can play in mutual understanding and cooperation in addressing global inequalities within the Muslim world.

Various forms of zakāt serve specific purposes in addressing economic disparities. One such form is zakāt al-fitr, which is prominently emphasized by imams during Ramadan and is considered obligatory (wājib) for all Muslims. It serves as a means to enable the poorest members of a community to participate in the celebration of breaking the fast (iftār) after Ramadan. The larger zakāt al-māl, paid on wealth above a certain quantity (niṣāb), receives comparatively less attention. In 2008, the Al-Azhar Islamic Research Academy proposed increasing the zakāt al-rikāz rate on oil revenues to 20% as a means of addressing wealth disparities. However, this proposal has not gained much support among oil-rich nations, possibly due to concerns about the potential impact on their economies and their desire to maintain control over their primary source of income. This situation highlights the necessity for a more comprehensive approach to leveraging zakāt as a tool for reducing economic inequality within the Muslim world.

There are compelling reasons, both from revelation and economic research, to believe that zakāt can play a significant role in reducing economic inequalities within the Muslim world.

On the one hand, the Qur’an cautions against corruption and the unjust accumulation of wealth. Sūrat al-Baqarah (Q. 2:188) states, “And do not consume one another’s wealth unjustly or send it [in bribery] to the rulers in order that [they might aid] you [to] consume a portion of the wealth of the people in sin, while you know [it is unlawful].” The Qur’an strongly emphasizes the importance of giving zakāt on wealth, as seen in Sūrat al-Tawbah (9:103), which states, “Take, [O, Muhammad], from their wealth a charity by which you purify them and cause them increase, and invoke [Allah’s blessings] upon them. Indeed, your invocations are reassurance for them. And Allah is Hearing and Knowing.”

On the other hand, modern economic research supports the implementation of zakāt-like instruments to reduce global inequality. Gabriel Zucman – recently awarded the John Bates Clark prize for an “economist under the age of forty who is judged to have made the most significant contribution to economic thought and knowledge” by the American Economic Association – has emphasized the need for a global wealth tax to reduce inequality. His work with co-authors Thomas Piketty and Emmanuel Saez highlights the role of tax havens and unrealized gains as ways for individuals to evade taxes and discusses the necessity for coordination in the international taxation of wealth. Similarly, in a recent issue of the prestigious Quarterly Journal of Economics, Guvenen et al., “Use-it-or-Lose-it: Efficiency Gains from Wealth Taxation” present an efficiency argument for implementing a wealth tax similar to zakāt al-māl. By redistributing wealth from those who use it less efficiently to those needy who can use it more effectively, zakāt al-māl can contribute to both economic growth and a more equitable redistribution of resources.

However, it is important to acknowledge that the divine wisdom behind zakāt extends beyond mere economic considerations and encompasses matters of this world and the Hereafter. Zakāt not only addresses economic inequalities but also fosters a sense of community and compassion, ensuring that wealth is utilized for the betterment of both the present life and for the rewards of the Hereafter. Nonetheless, we can draw insights from evidence in behavioral economics and international tax enforcement to enhance the practical collection and effective redistribution of zakāt to the most deserving individuals in the Ummah.

Behavioral economics offers valuable insights on tax enforcement that can be applied to improve zakāt collection.

Behavioral economics offers valuable insights on tax enforcement that can be applied to improve zakāt collection. Research in this field has shown that people’s decisions are influenced by factors such as social norms, fairness, and trust in institutions. For instance, studies have demonstrated that when taxpayers perceive tax compliance as a social norm, they are more likely to comply with their tax obligations. Therefore, promoting a culture of zakāt compliance and emphasizing its importance as a shared responsibility among Muslims can lead to higher collection rates overall. Additionally, ensuring transparency and accountability in the collection and distribution of zakāt funds can foster trust in the institutions responsible for managing these resources. In this regard, transnational organizations with a good reputation of transparency can play the role of zakāt collector when qualified scholars deem them eligible, as exemplified by the Refugee Zakat fund of the UN High Commissioner for Refugees. In particular, it is imperative that nonprofits collecting zakāt guarantee that none of the funds are used for operational expenses or salaries. Moreover, behavioral insights suggest that simplifying the process of calculating and paying zakāt, such as providing zakāt calculators, and offering timely reminders can further enhance compliance.

Muslims who fulfill both tax obligations and zakāt al-māl can encounter a dual financial burden as their wealth is subject to two separate obligations. In many countries, zakāt payments are not eligible for tax deductions, which means that Muslims are required to fulfill both their religious duty of paying zakāt and their civic duty of paying taxes. Furthermore, tax payments cannot serve as a substitute for zakāt, even if they contribute to social services, as zakāt is a distinct religious obligation with specific rules and purposes. This dual burden can be particularly challenging for Muslims residing in countries with high tax rates.

To align the tax and zakāt systems in countries with Islamic legal systems, policymakers could consider implementing measures that alleviate the burden on Muslims who fulfill both obligations. One approach could involve making zakāt payments tax-deductible, allowing Muslims to offset their zakāt contributions against their taxable income. This would acknowledge the significance of zakāt as a religious duty while alleviating the overall financial burden on Muslims. Another avenue could be to establish a unified system that integrates zakāt and tax collection, providing clear guidelines on the allocation of collected funds to social services and other eligible recipients of zakāt. Building on this unified system, an international body could be established to administer zakāt across countries operating under an Islamic legal framework, as implied by the title of this article.

“To align the tax and zakāt systems in countries with Islamic legal systems, policymakers could consider implementing measures that alleviate the burden on Muslims who fulfill both obligations.“

Delving further into this topic, several questions come to light. Firstly, how can zakāt al-māl be effectively integrated into contemporary fiscal structures, particularly in countries with a Muslim majority? Are there existing best practices that can be universally adopted? Additionally, in an increasingly globalized economy, how can we enhance the transparency and accountability of wealth, especially considering the potential for offshore tax havens to obscure wealth from religious obligations such as zakāt? How can faith-based motivations for zakāt compliance be reinforced in this context? Lastly, could principles of risk-sharing and equity in Islamic finance guide us towards using zakāt not merely as a tool for immediate consumption but as a means to provide financial capital for the underserved? The intersection of these questions with the realms of religion, economics, and public-policy reveals the complexity of these issues and the need for thorough examination. A future contribution will endeavor to answer some of these questions as part of this ongoing exploration about the potential of zakāt to tackle global economic inequality.

In conclusion, while economic insights can contribute to the practical collection of zakāt, it is important to recognize that the intention to fulfill zakāt ultimately stems from taqwā or God-consciousness. Taqwā serves as the driving force behind the fulfillment of our religious obligations, inspiring Muslims to give willingly and generously for the betterment of society. As mentioned in the Quran (Sūrat al-Baqarah, Q. 2:197), “[…] And take provisions, but indeed, the best provision is taqwā.” This verse serves as a reminder that, beyond economic considerations, it is the remembrance of God that guides us in fulfilling our responsibilities and working towards a more just and equitable world. May our adherence to taqwā inspire us to embrace the true essence of zakāt, contributing to the alleviation of economic disparities and fostering a future of compassion, solidarity, and shared global prosperity.

Abdoulaye Ndiaye is Assistant Professor of Economics. Prior to joining NYU Stern in July 2019, Professor Ndiaye was a Research Economist at the Federal Reserve Bank of Chicago. Professor Ndiaye’s research focuses on macroeconomics and public finance. Professor Ndiaye received a PhD in Economics from Northwestern University and a BS and MS in Economics and Finance from École Polytechnique in Paris. He has been a Visiting Scholar at the United Nations, Harvard University and Princeton University.